Bitcoin (BTC)

115,507.95 $ 0.28%Ethereum (ETH)

4,502.41 $ 2.74%Tether (USDT)

1.00 $ 0.03%Solana (SOL)

233.57 $ 4.00%USDC (USDC)

0.999976 $ 0.01%Dogecoin (DOGE)

0.264421 $ 5.25%Lido Staked Ether (STETH)

4,498.13 $ 2.59%TRON (TRX)

0.343971 $ 1.25%Cardano (ADA)

0.860982 $ 3.36%Wrapped stETH (WSTETH)

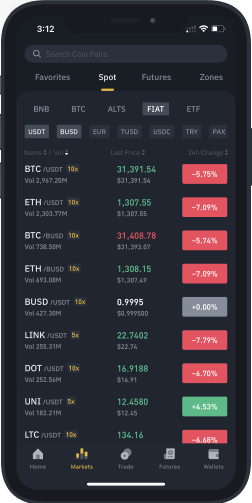

5,457.45 $ 2.54%Chainlink (LINK)

23.43 $ 3.35%Wrapped Beacon ETH (WBETH)

4,856.80 $ 2.68%Wrapped Bitcoin (WBTC)

115,565.96 $ 0.15%Hyperliquid (HYPE)

53.70 $ 1.02%Ethena USDe (USDE)

1.00 $ 0.08%Avalanche (AVAX)

29.51 $ 0.64%Figure Heloc (FIGR_HELOC)

0.995833 $ 0.25%Stellar (XLM)

0.379686 $ 2.51%Wrapped eETH (WEETH)

4,840.31 $ 2.45%Bitcoin Cash (BCH)

592.65 $ 0.45%WETH (WETH)

4,502.50 $ 2.55%Hedera (HBAR)

0.234504 $ 2.49%LEO Token (LEO)

9.56 $ 0.54%Litecoin (LTC)

113.46 $ 1.69%Toncoin (TON)

3.15 $ 1.28%USDS (USDS)

0.999609 $ 0.03%Cronos (CRO)

0.230631 $ 3.23%Shiba Inu (SHIB)

0.000013 $ 5.04%Binance Bridged USDT (BNB Smart Chain) (BSC-USD)

1.00 $ 0.02%Coinbase Wrapped BTC (CBBTC)

115,457.93 $ 0.30%Polkadot (DOT)

4.15 $ 4.36%WhiteBIT Coin (WBT)

43.63 $ 0.80%Ethena Staked USDe (SUSDE)

1.20 $ 0.02%World Liberty Financial (WLFI)

0.213593 $ 0.01%Monero (XMR)

303.37 $ 1.71%Uniswap (UNI)

9.14 $ 3.32%Mantle (MNT)

1.63 $ 0.88%Ethena (ENA)

0.710526 $ 5.43%Aave (AAVE)

298.73 $ 3.21%Bitget Token (BGB)

4.92 $ 0.43%Pepe (PEPE)

0.000011 $ 7.46%MemeCore (M)

2.51 $ 1.93%Jito Staked SOL (JITOSOL)

287.43 $ 3.91%NEAR Protocol (NEAR)

2.62 $ 3.26%Bittensor (TAO)

341.51 $ 3.08%