Bitcoin (BTC)

115,561.96 $ 0.38%Ethereum (ETH)

4,527.98 $ 1.91%Tether (USDT)

1.00 $ 0.04%Solana (SOL)

235.07 $ 3.15%USDC (USDC)

0.999975 $ 0.01%Dogecoin (DOGE)

0.268352 $ 4.27%Lido Staked Ether (STETH)

4,523.02 $ 1.91%TRON (TRX)

0.345012 $ 1.21%Cardano (ADA)

0.865187 $ 2.94%Wrapped stETH (WSTETH)

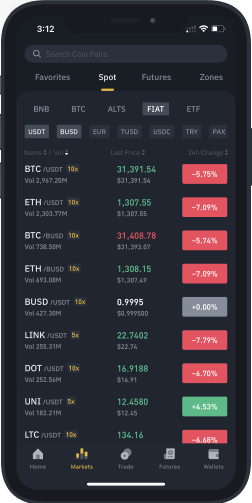

5,490.75 $ 1.96%Chainlink (LINK)

23.81 $ 1.80%Wrapped Beacon ETH (WBETH)

4,882.98 $ 1.97%Wrapped Bitcoin (WBTC)

115,594.97 $ 0.29%Hyperliquid (HYPE)

53.60 $ 0.94%Ethena USDe (USDE)

1.00 $ 0.07%Avalanche (AVAX)

30.26 $ 2.88%Figure Heloc (FIGR_HELOC)

0.995871 $ 0.24%Stellar (XLM)

0.380261 $ 2.91%Wrapped eETH (WEETH)

4,868.18 $ 1.95%Bitcoin Cash (BCH)

594.33 $ 0.02%WETH (WETH)

4,529.55 $ 2.01%Hedera (HBAR)

0.236369 $ 1.99%LEO Token (LEO)

9.57 $ 0.29%Litecoin (LTC)

113.65 $ 1.60%Toncoin (TON)

3.16 $ 1.17%USDS (USDS)

0.999651 $ 0.04%Cronos (CRO)

0.23174 $ 2.63%Shiba Inu (SHIB)

0.000013 $ 4.75%Binance Bridged USDT (BNB Smart Chain) (BSC-USD)

1.00 $ 0.04%Coinbase Wrapped BTC (CBBTC)

115,620.98 $ 0.47%Polkadot (DOT)

4.17 $ 3.85%WhiteBIT Coin (WBT)

43.72 $ 1.00%Ethena Staked USDe (SUSDE)

1.20 $ 0.01%World Liberty Financial (WLFI)

0.214813 $ 0.93%Monero (XMR)

306.31 $ 0.34%Uniswap (UNI)

9.16 $ 3.24%Mantle (MNT)

1.65 $ 3.40%Ethena (ENA)

0.708369 $ 5.82%Aave (AAVE)

300.04 $ 2.63%Bitget Token (BGB)

4.95 $ 0.20%Pepe (PEPE)

0.000011 $ 6.92%MemeCore (M)

2.52 $ 0.24%Jito Staked SOL (JITOSOL)

289.42 $ 3.07%Bittensor (TAO)

342.79 $ 3.10%NEAR Protocol (NEAR)

2.63 $ 2.94%